個人想法說在前頭

川普現在2024年6月的氣勢明顯壓過尋求連任的拜登,相形於拜登,個人會更關注川普的政策宣示,一則因為拜登似乎想延續第一任期的政策走向,二則因為川普為競選再任,也會端出顯眼的政策牛肉,三則川普任內的諸多財政政策,以現在來看,並沒有太大的問題,現在美國的經濟也不錯,四則川普任內的財政政策,我曾花過一點時間瞭解,當下觀感是川普的改革都是找對重點,像極一位務實老司機。

川普計劃選上後,延續減稅道路,並再將聯邦企業稅率下降至20%(另有州企業稅)=>跟台灣營所稅率一樣,相信會是推動Made in America的起手式,高科技產業鏈會設法移回美國,值得我們用四年好好觀察。

Personal Thoughts First

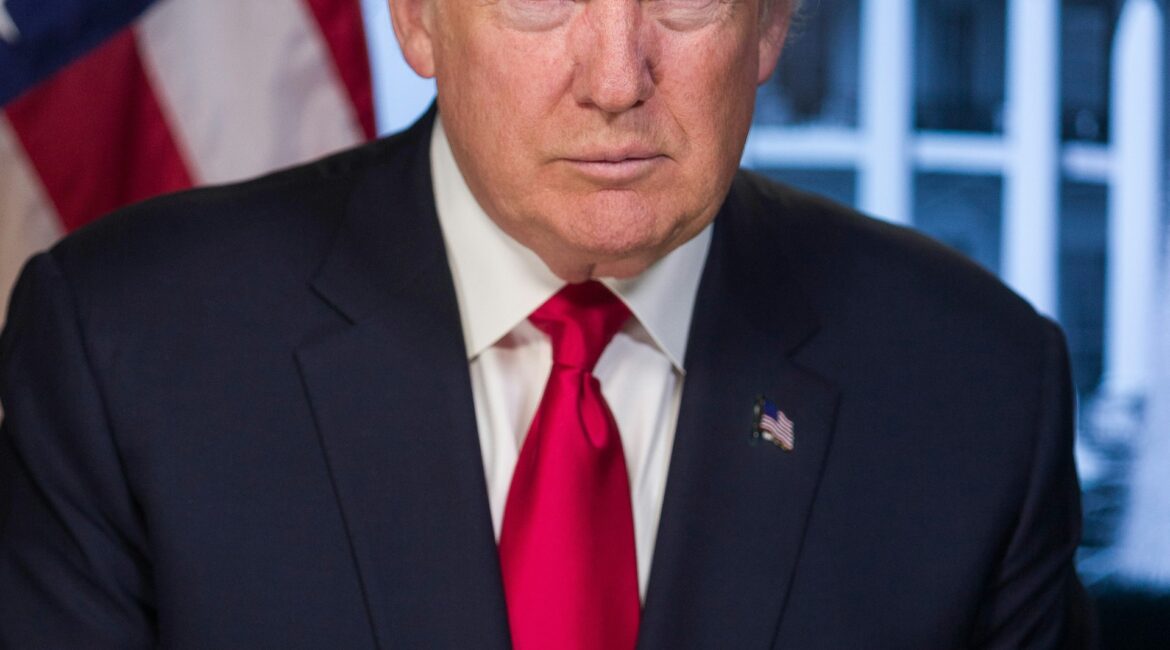

As of June 2024, it is evident that Trump’s momentum is surpassing that of Biden, who is seeking re-election. Personally, I am more focused on Trump’s policy declarations for several reasons. First, Biden seems intent on continuing the policy direction of his first term. Second, Trump, in his bid for re-election, will likely present substantial policy proposals to attract voters’ attention as well as corporate donors’. Third, many of Trump’s fiscal policies during his tenure, from today’s perspective, do not seem to have major issues, and the current state of the U.S. economy is quite good. Fourth, I have spent some time understanding Trump’s fiscal policies during his term, and my impression is that Trump’s reforms targeted the right areas, resembling a pragmatic old hand.

Trump plans to continue the tax reduction path if re-elected and further lower the federal corporate tax rate to 20% (in addition to state corporate taxes), which would be the same to Taiwan’s corporate tax rate. This is likely to be the initial move to promote “Made in America,” and the high-tech industry chain will strive to move back to the U.S. This development is worth observing closely over the next four years.

川普跟大款CEO保證,選上延續減稅的道路

川普說選上後,會延續先前2017減稅法案

加徵關稅與否,川普立場尚不明確

川普的2017減稅方案(TCJA)將於2025年底到期的衝擊與影響

拜登反對延長,若是拜登選上,富人減稅不再

2017減稅方案有哪些項目可能到期失效

-

降低了多數個人所得稅稅率,特別是將最高稅率從39.6%降至37%。

-

幾乎將標準扣除額翻倍,現在只有大約10%的申報者逐項列出扣除額。

-

將州和地方稅的扣除額上限設定為每位申報者10,000美元。

-

將年度兒童稅收抵免額翻倍至2,000美元,並允許更多高收入父母申請

-

顯著減少了受替代最低稅(AMT)影響的申報者數量。

-

將遺產和贈與稅的免稅額翻倍,因此更少的富人需繳納這些稅。

-

容許合夥企業的業主在個人所得稅申報中繳納其企業稅。這項扣除也將在2025年底到期,允許這些納稅人從聯邦所得稅中排除最多20%的業務收入。