Pic is generate by Bing AI

Taiwan’s VAT on cross-border E-commerce

According to Article 2-1 of the Value-Added and Non-Value-Added Business Tax Act (VAT Act), a foreign enterprise without a fixed place of business within the territory of Taiwan that sells electronic services over the internet or other digital networks to individuals located in Taiwan is treated as a VAT taxpayer for VAT purpose. Beginning January 1, 2025, the threshold for a foreign e-commerce enterprise to register as a VAT entity is increased to NT$600,000(approximately USD 20,000), aligning with the threshold applicable to domestic enterprises.

The applicable VAT rate today and before is 5%.

Taiwan’s CIT on cross-border E-commerce

Taiwan’s corporate income tax (CIT) on cross-border e-commerce is generally calculated based on sales to consumers (B2C), applying an effective tax rate ranging from 3% to 6%, depending on the allocation of contribution between the local market and the foreign operating headquarters. In the latter mentioned German case, it is highly likely that the tax authorities have obtained sales information through cooperating local agent companies or by tracking credit card payment flows.

It should be noted that, under a strict reading of Taiwan’s Income Tax Act, cross-border e-commerce companies without a fixed place of business or a permanent establishment (PE) within Taiwan should not bear CIT reporting and payment obligations. The Act imposes such tax liabilities only on foreign enterprises with a domestic fixed place of business. Instead, cross-border e-commerce companies without a PE should be subject to withholding tax obligations by domestic enterprises that pay for their electronic services. Consequently, the legality of the Taiwan tax authorities imposing CIT on these cross-border e-commerce enterprises could be subject to challenge.

Furthermore, the availability of tax treaty exemptions should be emphasized. Even without raising a direct legal challenge to the imposition of CIT, cross-border e-commerce enterprises without a fixed place of business in Taiwan may apply for treaty benefits to exempt their Taiwan-sourced business income from taxation, provided they are located in jurisdictions that maintain a double tax treaty with Taiwan, such as Singapore, Japan, and the Netherlands, among others.

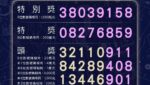

Tax Arrears of German E-Commerce Company

A well-known German e-commerce company, specializing in remote connection software, failed to pay Taiwan’s corporate income tax for fiscal years 2020 to 2022, accumulating tax arrears totaling NT$3.35 million, approximately 100,000 Euro.

In July 2023, the Taipei National Taxation Bureau transferred the case to the Taipei Branch of the Administrative Enforcement Agency for enforcement.

Challenges in Enforcement

Although the company had completed tax registration in Taiwan, it had neither a fixed place of business nor a business agent in the country. Moreover, no assets or income subject to enforcement could be located domestically, making enforcement efforts difficult for the Taipei Branch.

Failed Attempt at Cross-Border Serve Service

The Taipei Branch requested assistance from the Ministry of Foreign Affairs’ Munich Office in Germany to serve the enforcement order. However, despite the company receiving the documents, it did not respond, and attempts to seize sales receivables from its local transactions also failed.

Breakthrough Progress

Through coordination with partner companies in Taiwan, the Taipei Branch successfully obtained the company’s business contact information, establishing direct communication with the German e-commerce firm.

Successful Recovery of Tax Arrears

After one year and seven months of persistent efforts, the Taipei Branch contacted the company via email, explained the details of the tax arrears and payment methods, and eventually, in February 2025, the company remitted the full amount to the designated account, concluding the case.

This story is summarized from the news report: https://www.chinatimes.com/realtimenews/20250331001645-260402?chdtv

The Chinese version

-

德國電商欠稅知名遠端連線軟體的德國電商因未繳納台灣109至111年度營所稅,累積欠稅達新台幣335萬元,2023年7月遭台北國稅局移送行政執行署台北分署執行。

-

執行困難原因該電商雖已在台辦理稅籍登記,但無固定營業場所及營業代理人,國內亦查無可供執行財產,導致台北分署執行受阻。

-

跨海協助送達失敗台北分署曾囑託外交部駐德國慕尼黑辦事處協助送達執行命令,但對方收受後未回應,且對該電商銷售債權的扣押行動亦未成功。

-

突破進展透過與台灣合作廠商協調,台北分署取得該電商的商務聯絡窗口資料,成功建立直接聯繫。

-

追回欠稅成果歷經1年7個多月,台北分署透過電子郵件聯繫,說明欠稅與繳納方式,最終該德國電商於2025年2月將全額稅款匯入指定帳戶,案件結案。