Fact Sheet

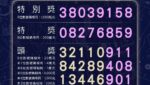

Ministry of Finance Announces First Filing Results of the Controlled Foreign Company (CFC) Tax Regime – NT$27 Billion (US$0.9 Billion) in Tax Revenue!

The CFC tax regime officially came into effect in 2023, with its first filing in May 2024. Under the new regulations, regardless of whether a CFC distributes its earnings, both individuals and businesses must include the income in their taxable earnings and pay taxes accordingly.

- Corporate Filings: Over 2,600 companies, total tax paid approximately NT$22 billion

- Individual Filings: Over 1,400 individuals, total tax paid approximately NT$5 billion

- Total Tax Revenue: NT$27 billion

財政部關於 受控外國企業(CFC)稅制 的首度申報結果,270億元稅收!

該制度於 2023 年正式上路,2024 年 5 月首次申報,規定無論 CFC 是否分配盈餘,個人與企業皆需計入所得並繳納稅款。

申報結果:

企業申報:2600 多家,總繳納 約 220 億元

個人申報:1400 多戶,總繳納 約 50 億元

合計稅收:270 億元

Taiwan implemented CFC regime on 2023

To prevent tax avoidance, where companies or individuals establish CFCs in low-tax jurisdictions and retain undistributed earnings to evade Taiwan’s tax obligations, Taiwan firstly legislated CFC tax regime in 2016 and then implemented since 2023, with the first filings in May 2024. Under this system, regardless of whether a CFC decides to distribute earnings, individuals must include CFC profits in their basic taxable income, while businesses must recognize CFC investment income as part of their taxable corporate income, both of which are subject to income tax.

The Ministry of Finance’s Taxation Administration released relevant statistics today, confirming that 2,600 businesses and 1,400 individuals declared their CFC-related income. Filers were categorized into taxpayers and those exempted under the safe harbor rule. Based on preliminary calculations, businesses contributed NT$22 billion, and individuals paid NT$5 billion, bringing the total tax revenue to NT$27 billion.

Tax Bureau start auditing CFC declarations

Officials stated that after the May 2024 filing, the National Taxation Bureau launched audits on cases involving inaccurate or undisclosed declarations and intends to maintain this audit approach in the coming year. Additionally, the bureau will utilize AI-powered big data analysis to identify potential non-filers and issue guidance notices urging them to submit their reports promptly.

Taiwan’s CFC Regime (Implemented in 2023)

Taiwan implemented its CFC regime to counter tax avoidance through offshore entities. Under the new rules:

- Corporations must recognize CFC investment income as part of their taxable corporate income.

- Individuals must include CFC profits in their personal taxable income.

- The first mandatory filings took place in May 2024, leading to NT$27 billion in tax revenue from CFCs.