English Summary

- The tax treaty signed in November 2021 by Taiwan and Korea was entered into with reference to OECD model tax conventions.

- In 2020, the bilateral trade between both countries amounted to US$35.74 billion. Taiwan and Korea have become each other’s 5th largest trading partner.

- The tax treaty is the 2nd Income Tax Agreement that Taiwan concluded with Northeast Asian countries after Japan.

- Per Taiwan PWC, before the tax treaty, Taiwanese companies used to invest through third jurisdictions, like BVI or Cayman, and subject to 22% dividends withholding. After the tax treaty enters into force, the dividends withholding rate can be reduced to 10~15%, which also prevents double taxation in Taiwan.

中文摘要

- 臺韓租稅協定於110年11月17日完成異地簽署,該協定將俟雙方各自完成國內法定程序並以書面相互通知後,自後通知之日生效,並自生效日次年1月1日起適用。

- 我國與韓國經貿關係密切,去(109)年臺韓雙邊貿易總額達357億4,070萬美元,臺韓互為對方第5大貿易夥伴。

- 財政部表示,臺韓租稅協定為繼日本之後,我國與東北亞國家簽署之第2個所得稅協定,該協定簽署有助未來我國與其他國家洽簽所得稅協定及國際競爭力之提升。

- 資誠林會計師指出,過往因無租稅協定,台商多透過如BVI、開曼等第三地境外公司轉投資,而台商投資南韓子公司獲配股利需負擔扣繳稅率22%,未來台商可直接申請適用優惠扣繳稅率(10~15%),台商回台報稅時,可扣抵我國20%的營所稅,僅就剩下部分繳納5~10%,一來一往可節省2%所得稅負。

參考資料與連結 References

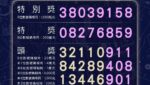

- 我國與韓國簽署「避免所得稅雙重課稅及防杜逃稅協定」,財政部,2021/11/30

- The Agreement between the Taipei Mission in Korea and the Korean Mission in Taipei for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income was signed, MOF Taiwan, 2021/11/30

- 台韓租稅協定 完成洽簽 – A4 綜合要聞 – 20211201 – 工商時報